Holding Company In UAE: Everything you need to know

Did you know that you can establish your own Holding Company in UAE if you are considering Dubai as your business destination? Opening your holding company in Dubai is relatively easy and does not require investing a hefty amount of capital. A holding company offers various advantages, including asset protection, tax efficiency, limited liability, and more.

In this article, we will provide a comprehensive explanation of what a holding company is and how it operates in the UAE. We will also discuss the benefits of having a holding company in UAE, the permitted company types, the necessary prerequisites for establishing a holding company, the associated costs, and additional details.

What is a Holding Company?

A holding company is an organizational arrangement that possesses assets, such as property, and/or one or multiple subsidiary companies. The primary function of a holding company is to acquire ownership of businesses or assets within the group. It serves as a tax-efficient strategy for businesses seeking to structure themselves when they possess a diverse range of assets and aim to restrict their liability.

Conceptually, a holding company can be envisioned as a parent company that maintains a controlling interest, potentially up to 100%, in all its subsidiaries and assets. As such, it assumes overall authority over the group, but it abstains from direct involvement in the operational management of those companies or the administration of assets.

Holding companies do not engage in the provision of other services or activities. They do not directly oversee the corporations within the group, nor do they administer assets or participate in decision-making processes for subsidiary companies.

Allowed Activities for Holding Company

It is understandable that holding companies are restricted to specific activities. Their scope is limited to the ownership of various assets, including physical properties (both commercial and residential), intellectual property, and subsidiary businesses.

Consequently, holding companies are prohibited from engaging in direct product manufacturing, the sale of goods or services, or the direct management of assets held within the holding company.

Requirement for Holding Companies

Holding companies must adhere to specific requirements when establishing themselves in Dubai. Alongside complying with company law regulations, the following conditions apply:

- Formation of a management board responsible for determining organizational policies for subsidiaries.

- Supervision of subsidiary activities by the management board.

- Appointment of directors for each subsidiary company.

- Ensuring that subsidiary businesses have adequate capital resources for sustainability.

- Implementing risk mitigation strategies to minimize the risk exposure of subsidiaries.

Benefits Of Opening A Holding Company In Dubai, UAE

When establishing a holding company in Dubai, you can enjoy a range of benefits that are similar to those offered in other jurisdictions. However, there are additional advantages associated with being based in the United Arab Emirates. Here are some of the key benefits of opening a holding company in Dubai:

1. No Share Capital Requirement

If you choose to establish your holding company in Free Zone , there is no mandatory share capital requirement.

2. Tax Efficiency

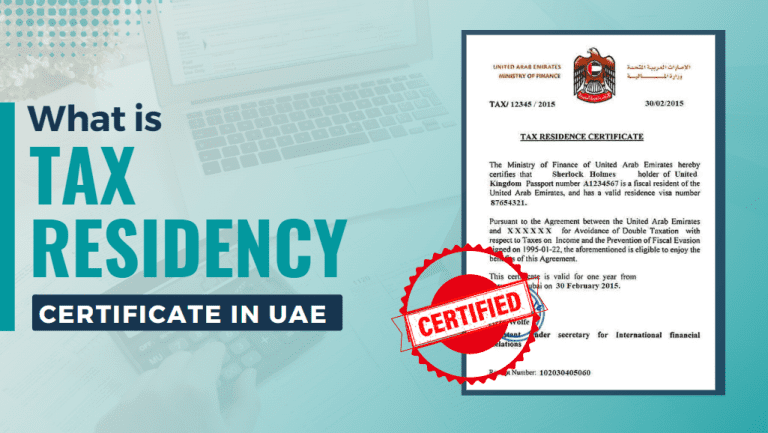

The United Arab Emirates is renowned for its zero tax rates. By establishing your holding company in a free zone, you can benefit from 0% tax and 0% VAT obligations.

3. Risk Mitigation

Similar to holding companies established in other locations, a Dubai holding company assists in mitigating risk. Your business will not be held accountable for any risks or debts incurred by your subsidiaries.

4. Residency Visa Route

With a license, you have the opportunity to own property under the company structure. This safeguards your property from potential seizure in the event of bankruptcy within your other business ventures.

How Holding Companies Operate and Functions

In Dubai, holding companies function by selecting a shareholder board. This board assumes the responsibility of determining the structure of subsidiary ownership and casting votes on crucial matters like mergers, acquisitions, sales of subsidiaries or assets. Additionally, it maintains oversight over the activities of subsidiary companies, regularly assessing their performance and ensuring their financial sustainability.

Holding companies serve the purpose of either holding shares in subsidiary companies or owning assets. Business owners or shareholders frequently opt to establish holding companies as a mechanism to restrict liability in the event of any issues arising with their subsidiary companies. This enables them to mitigate potential risks and safeguard their interests.

How to Open a Holding Company in UAE?

If you are planning to open a holding company in the UAE, it is crucial to follow specific steps. These steps include:

- Selecting the appropriate business activity for your holding company.

- Obtaining the necessary approvals from relevant departments and authorities.

- Acquiring a trade license from the relevant authority in the Emirate or free zone where you intend to establish your business. For instance, if you choose Dubai as your base, you need to obtain a license from the Department of Economy & Tourism in Dubai (DED). In Abu Dhabi, you would require a license from the Abu Dhabi Department of Economic Development (ADDED).

- Registering your holding company with the Ministry of Economy (MOE) or the respective free zone authority.

- Opening a corporate bank account in the UAE.

- Applying for visas if they are required for your business operations.

By following these steps, you can ensure the proper establishment and operation of your holding company in the UAE. Ability in the event of any issues arising with their subsidiary companies. This enables them to mitigate potential risks and safeguard their interests.

Conclusion

In conclusion, establishing a holding company in the UAE provides effective asset management and protection. It presents numerous advantages, including tax efficiency, reduced risks, no obligatory share capital, enhanced flexibility, and diversified subsidiary companies.

While the process itself is uncomplicated, it is crucial to ensure proper documentation and accurate completion of paperwork for a smooth experience. At MARKEF, our experienced business consultants specialize in Dubai and UAE business formation. Contact us today to simplify the process and commence your holding company journey in the UAE.