What is a Tax Residency Certificate in UAE?

What is TAX Residency Certificate

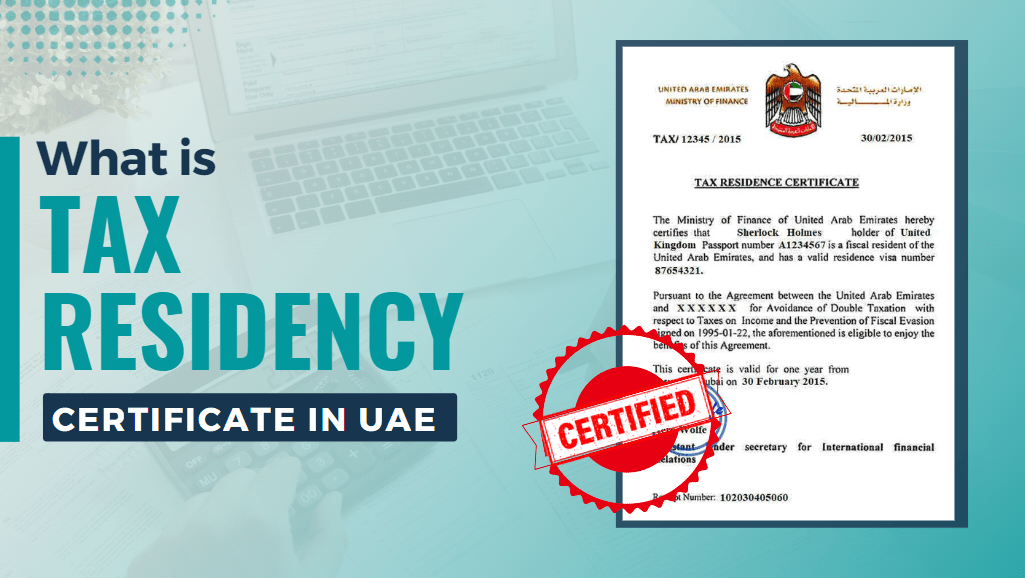

The Tax Residency Certificate (TRC) is a certificate issued for eligible government entities, companies, and individuals. The document proves that you pay taxes to a certain country and gives you the right to benefit from double taxation avoidance agreements. In the UAE, Federal Tax Authority (FTA) is responsible for issuing the certificate of tax residence and you can get a certificate issued to a company registered in the UAE as well as for individuals residing in the UAE.

Who Needs a Tax Residency Certificate in UAE?

Any company operating on the mainland or in a Free Zone that has been active in the UAE for at least a year is eligible for The Tax Residency Certificate. However, Offshore companies are ineligible for this and must receive a tax exemption certificate instead of the Tax Residency Certificate. Also, individuals who have resided in the UAE for at least 180 days are eligible for The Tax Residency Certificate. This is especially beneficial for individuals whose mother countries do not have a double taxation agreement with the UAE, the individuals must have a valid UAE resident visa for more than 180 days to apply.

Benefits of a Tax Residency Certificate

- Avail of tax benefits associated with Double Taxation Avoidance Agreements.

- Helps avoid having to pay higher taxes, enabling you to save on valuable resources.

- In case you are a part of the CRS group of nations, the TRC helps with maintaining compliance.

- Allows you to claim excess taxes paid.

- Protects the national economy by ensuring fairness for both taxpayers and the government.

- Builds credibility and transparency for the company involved.

- Proves residency in the UAE, helping establish authenticity.

How to Obtain a Tax Residency Certificate in UAE

- Create an account on the payable to the UAE Federal Tax Authority portal

- Complete the application form

- Upload the required documents in PDF or JPEG format

- Your application and attached documents will be verified and if they meet the criteria, you’ll receive a confirmation email to pay the remaining fees via the system

- After payment confirmation, you’ll receive the certificate via an express courier

Documents Required for Companies

- Valid UAE Trade License, active for over 1 year in (Mainland DED or Freezone)

- A copy of the Memorandum of Association of the company

- A copy of the Certificate of Incumbency for the company (normally the Chamber of Commerce certificate)

- The company organizational structure chart

- A copy or a title deed of a certified commercial tenancy contract (valid for at least three months prior to application) with a physical office space as virtual office space will not be accepted

- A copy of a valid passport and a valid UAE resident visa

- A copy of Emirates ID of the company directors, shareholders, or managers

- Latest certified audited financial statement or UAE company bank statements from the last 6 months, stamped by the UAE bank

- Tax Residency Certificate application fees are AED 10,000, payable to the UAE Federal Tax Authority through the e-Dirham Card

Documents Required for Individual

- A passport copy and a valid visa copy are issued at least 180 days prior to the application

- An Emirates ID copy

- 6 months of personal UAE bank statements, stamped by the UAE bank

- Proof of income in UAE such as an employment agreement, share certificate, or salary certificate

- A report from the General Directorate of Residency and Foreign Affairs shows evidence of all entries into and exits from the UAE

- A copy or a title deed of the certified tenancy contract valid for at least three months prior to application

- Tax Domicile Certificate application fees are AED 2000, payable to the UAE Federal Tax Authority through the e-Dirham Card

Tax Residency Certificate Application Process

- First and foremost, you need to ensure that you or your company meets the eligibility criteria mentioned above.

- In case you do qualify, you can approach the Ministry of Finance. Visit official portal, and from the homepage, you should navigate to the Application section.

- From there, you must fill out the form for the Tax Residency Certificate and submit the same after careful verification.

- Also, you must be ready to submit all the supporting documents required, and you can upload the same through the portal.

- The Ministry of Finance will then conduct an extensive review of your documents and application, which may take anywhere between 2 to 4 weeks.

- Furthermore, you must also complete the payment of the required fees through the payment methods listed on the website.

- After successful verification, the Tax Residency Certificate will be made available to you.

The Tax Residency Certificate is an important document for expats living in the UAE. It certifies an individual’s tax residency status in the country and offers several benefits, including the avoidance of double taxation and access to banking and government services. To apply for the TRC, individuals must meet the eligibility criteria and MARKEF can be complete all the process to obtain TRC within a few weeks. If you’re an expat living in the UAE, consider applying for the TRC to take advantage of its benefits and simplify your tax filing process.