Benefits of Virtual CFO services in Dubai

In the dynamic landscape of growing organizations, effective financial planning, cash flow management, and sustainable growth strategies become paramount. Traditionally, these responsibilities fall under the domain of a Chief Financial Officer (CFO). However, the advent of remote Virtual CFO services presents a cost-effective alternative that provides the same expertise without the financial commitment associated with hiring a full-time CFO. Let’s delve into the myriad benefits of opting for VCFO services over an in-house CFO.

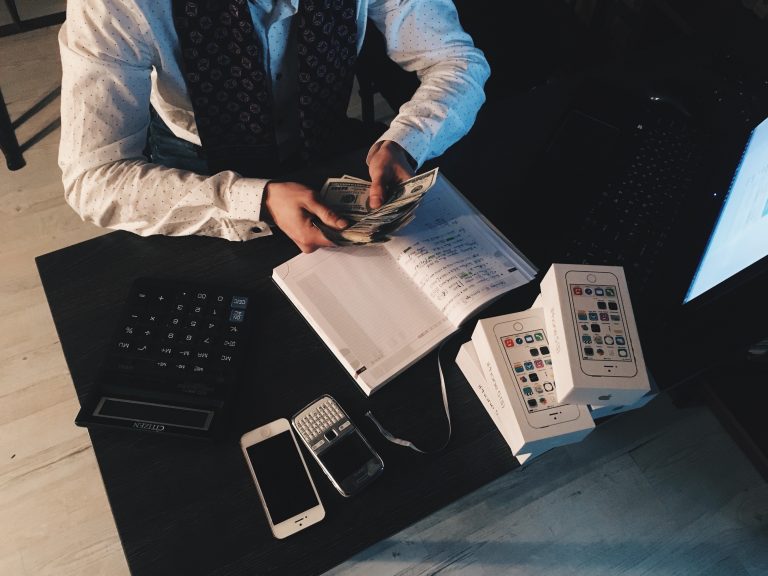

1. Cost Efficiency:

Virtual CFO services eliminate the financial burdens of hiring a full-time executive, offering a more cost-effective solution. The pricing is tailored to your specific needs, ensuring that you pay for the services you require without the overhead costs of bonuses and benefits.

2. Flexibility and Scalability:

VCFO services provide the flexibility to tailor terms based on your organization’s requirements. Whether you need full-time or part-time support, working hours can be scaled up or down to align with your business’s evolving needs.

3. Technological Integration:

Leading VCFO services leverage modern technology, including AI and advanced data analytics, to enhance financial processes. This integration ensures efficient accounting compliance and the creation of reliable financial projections.

4. Budget Control:

Virtual CFO services deliver comprehensive budgetary analysis reports, allowing you to monitor spending, re-evaluate, and maintain control over your organization’s budget effectively.

5. Increased Cash Flow:

VCFOs offer valuable insights and implement recommendations to improve specific business areas, ultimately boosting cash flow. Their expertise allows them to analyze financial structures and spending patterns, providing actionable solutions.

6. Diverse Industry Experience:

Virtual CFOs bring a wealth of experience from various industries, providing your organization with a broad spectrum of insights and networks. This diverse background enhances problem-solving capabilities and strategic decision-making.

7. Team of CFOs at Your Disposal:

Engaging a VCFO from an external team means tapping into the collective knowledge of experienced CFOs. While you have a designated point of contact, you benefit from the expertise of an entire team monitoring your organization’s financial aspects.

8. Vast Network:

VCFOs, especially those part of organized teams, have access to extensive professional networks, including financiers and other economic experts. This network proves invaluable when seeking funds or planning expansion.

9. Ability to Handle Any Challenge:

With experience across various organizations and industries, VCFOs are equipped to tackle a range of challenges. Their collective expertise ensures innovative and effective solutions, even in the face of new and unique problems.

How MARKEF can help you

Embark on a digital transformation journey with MARKEF Accounting services. These end-to-end solutions empower CFOs to efficiently carry out their duties, supporting business growth through robust decision-making. Explore how MARKEF’s services can elevate your organization’s financial management, providing actionable insights and facilitating agile responses to a rapidly changing business landscape.

Conclusion:

In the era of digital transformation, the agility offered by VCFO services is crucial for organizational success. Whether embracing a full digital mindset or opting for a modular suite of services, the goal is to build connected organizations that innovate collaboratively for the future. MARKEF stands ready to assist organizations in achieving financial excellence through digital transformation. Reach out to discover the transformative potential for your organization.