Financial Planning for Startups: What You Need to Know

Every startup needs to have a solid business plan in order for it to survive the initial stages and grow into a successful business. A business plan includes numerous aspects but one of the most important segments of it is the financial plan for a startup. Financial planning refers to the process of understanding how your company is going to achieve its strategic goals and financial objectives. This constitutes a broad range of financial activities, including cash flow analysis, the production of financial models and simulations, analysis of internal controls, and creating and implementing annual growth strategies.

1. Importance of Financial Planning for Startups

It costs money to grow a business, and most people don’t have unlimited resources. If you don’t plan for how you’re going to grow and how much it’s going to cost, you can easily waste your two most precious resources—time and money. You should also consider the fact that it’s a necessary part of building a viable business model. Without a financial plan, you won’t be able to quantify your assumptions about the business. Finally, financial plans can provide your company with benchmarks and targets to achieve, which is an effective way to measure the success of your company, particularly in the early years when you may not be making a profit

2. Creating a Budget

One of the first things you should do when planning your startup’s finances is to create a budget. A budget will help you to identify your expenses and revenues and determine how much money you need to keep your business running. Be sure to account for all expenses, including salaries, rent, utilities, equipment, and marketing.

3. Forecasting Your Financials

Forecasting is the process of predicting your startup’s financial performance over a specific period. This is an essential part of financial planning because it helps you to anticipate potential problems and plan accordingly. When forecasting, be sure to consider factors such as market trends, competition, and potential risks.

4. Raising Funds

Most startups require external funding to get off the ground. There are various ways to raise funds, including bootstrapping, crowdfunding, and venture capital. Each option has its pros and cons, and you should carefully consider which one is right for your business.

5. Managing Cash Flow

Cash flow is the lifeblood of any business. It refers to the movement of money in and out of your business. As a startup, it is crucial to manage your cash flow carefully to ensure that you have enough money to cover your expenses and invest in growth opportunities.

6. Planning for the Future

Financial planning is not just about managing your startup’s finances in the present; it is also about planning for the future. As your business grows, your financial needs will change, and you will need to adjust your financial plan accordingly. Be sure to review your plan regularly and make adjustments as needed.

Define Your Financial Goals

Setting goals is an incredibly important habit in business and it’s all the more important when those goals are financial, as the success of your business is inevitably measured by the numbers it achieves. Once you know what you want to achieve, you can start to develop a plan to get there. Below are 3 essential financial goals for any business:

1. Financial Knowledge

Financial knowledge is the key to making financial progress. If you’re not great with accounting, the delegation will be one of the first areas you outsource. Or perhaps you have an accountant or an entire accounting department on staff. As the boss, you must still be aware of what’s happening financially. You should know where your money is going and what it’s doing.

2. Financial Management

Managing your money means making your money earn its keep. Your money should always be working for you. Pop it in an investment account, a mutual fund, or an interest-bearing savings account. Lend it out and earn interest that way. It doesn’t matter if the amount you have to work with is AED100 or AED1 million. Every dirham you have can work for you, and should. Think of your funds as an employee. You wouldn’t let your employees sit around idly on your time, twiddling their thumbs and taking up space. You give them work and you expect them to do it.

3. Financial Perspective

A prospering business has money coming in and money going out. Keeping this perspective is tough when money is tight and you’re barely avoiding the red ink, but it’s important to invest in systems and tools that will help you to meet your customers’ needs effectively. When you stop the money from flowing in, your business will soon run dry. Stop the money from flowing out, and the business will stagnate. No money out means you’re not growing and improving your business. Your customers will soon catch on, and the money will stop coming in. However, avoid unnecessary spending, but don’t avoid necessary investments back into your business.

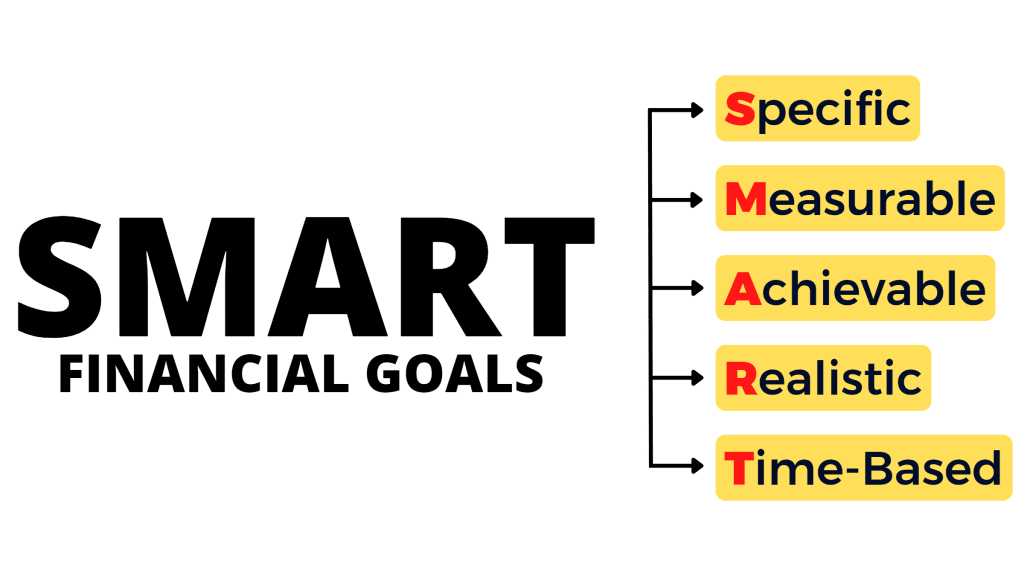

What are SMART financial goals?

Specific

When you’re setting a financial goal, you need to be specific about what you want to achieve. Vague goals like “saving more money” or “getting out of debt” are not going to cut it.

Measurable

Make your financial goal measurable by quantifying it so you can evaluate your progress and overall success. Express your goals in clear numbers, so you’ll know where you are and when you’ve succeeded.

Achievable

One of the biggest obstacles to achieving a goal is setting your expectations too high. The surest way to improve your financial situation is to take achievable steps. If that means taking smaller steps, that’s ok. You can always set a new goal!

Realistic

When setting the goal, assess the steps you plan to take to achieve the goal. Ask yourself if those steps are realistic given your current circumstances. Setting unrealistic goals usually leads to disappointment and surrender.

Time- Based

Ever had an assignment that you pushed off to the last minute? That feeling of pressure to meet a deadline can light a fire under you to reach your goal. Give yourself a time frame to achieve this goal. This will encourage you to follow through, stop procrastinating, and keep yourself accountable.

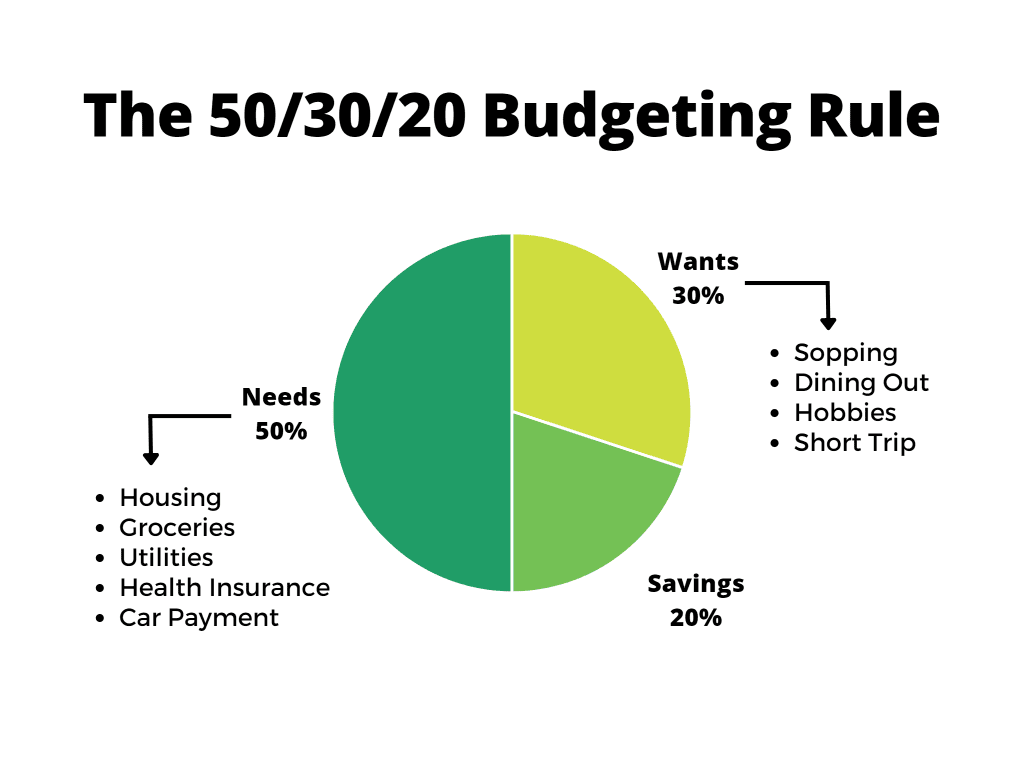

50%: Needs

Needs are those bills that you absolutely must pay and are the things necessary for survival. These include rent or mortgage payments, car payments, groceries, insurance, health care, minimum debt payment, and utilities. These are your “must-haves.” The “needs” category does not include items that are extras, such as HBO, Netflix, Starbucks, and dining out.

30%: Wants

Wants are all the things you spend money on that are not absolutely essential. This includes dinner and movies out, that new handbag, tickets to sporting events, vacations, the latest electronic gadget, and ultra-high-speed Internet. Anything in the “wants” bucket is optional if you boil it down. You can work out at home instead of going to the gym, cook instead of eating out, or watch sports on TV instead of getting tickets to the game.

20%: Savings

Finally, try to allocate 20% of your net income to savings and investments. This includes adding money to an emergency fund in a bank savings account, making IRA contributions to a mutual fund account, and investing in the stock market. You should have at least three months of emergency savings on hand in case you lose your job or an unforeseen event occurs. After that, focus on retirement and meeting other financial goals down the road.

The 50-30-20 rule is intended to help individuals manage their after-tax income, primarily to have funds on hand for emergencies and savings for retirement. Every household should prioritize creating an emergency fund in case of job losses, unexpected medical expenses, or any other unforeseen monetary cost. If an emergency fund is used, then a household should focus on replenishing it.

FAQ :

Financial planning for startups involves creating a financial plan that outlines how much money you need to launch your business and how you plan to manage your finances over time.

Financial planning is important for startups because it helps you manage your cash flow, make informed decisions about where to allocate your resources, and plan for the future.

Funding options for startups include loans, grants, and investments.

Subscribe to Our News Letter

Blogs you might find useful :

We're here to help you! Reach out for solutions.

We're here to help you! Reach out for solutions.

Don't let doubts hold your business back.

Have any questions? Reach us by phone.

We're here for you! Reach us by mail.

Contact Us

We Always here to help you!

Business Setup

Tax Services

Consulting Services

Accounting Services

Compliance

Audit & Assurance

Quick Links

MARKEF is a leading Accounting Firm offering wide range of services including Accounting and Bookkeeping, Audit and Assurance, VAT and Corporate Tax, Business Consulting, Management Consulting, and Business Setup Services in Dubai and across United Arab Emirates.

- Office No.1929, Tamani Art's Offices Tower, Business Bay, Dubai, United Arab Emirates

- +971 4 589 2828

- +971 50 105 4241

- E-mail : info@markef.com

-

Mon - Sat : 8:00 - 18:00

Sunday Closed